On November 11, the 3rd International Symposium on China's Capital Market and the Reform of State-owned Assets and State-owned Enterprises (2023) and the 4th International Conference on Uncertainty and Financial Markets in Asia-Pacific were successfully held at our university. This seminar was co-sponsored by Business School, Research Institute of State-owned Assets, Collaborative Innovation Center for State-owned Assets Management, Digital Business Department, and Capital Development Center of Beijing Technology and Business University. Academic support came from the Pacific-Basin Finance Journal and Asia-Pacific Applied Economics Association.

Professor Guo Jianhua, Deputy Party Secretary and President of Beijing Technology and Business University, attended the meeting and delivered a speech. Paresh Narayan, Founder and President of Asia Pacific Association of Applied Economics and Professor of Monash University, Australia, Robert Faff, Chief Editor of Pacific-Basin Finance Journal, Professor of Bond University, Australia, Professor Huang Kujian, President of China Enterprise Management Research Society, More than 160 experts and scholars from more than 50 universities including Tsinghua University, Xiamen University, Beijing Normal University, Hunan University, University of International Business and Economics, Central University of Finance and Economics, Southwest University of Finance and Law, Zhong Nan University of Economics and Law attended the conference. Dean of Business School, Professor He Yurun, and Dean of the Graduate School, Professor Mao Xinshu, presided over the opening ceremony and keynote speech sessions respectively.

In his opening remarks, President Guo welcomed all attendees warmly while expressing gratitude for their participation. He noted that as a leading research institution in Beijing focused on business studies—light industry—and food sectors—the university is committed to an integrated development strategy emphasizing 'strengthening business operations', 'refining engineering practices', 'merging industry with commerce'. By addressing key issues like state asset reform alongside digital economy dynamics investor protection—the university actively contributes to national industrial advancements offering insights into policy formulation impacting economic growth within capital cities. He also expressed hope that scholars would collaborate to share innovative ideas contributing valuable suggestions regarding developments in China’s capital markets reforms thus elevating this symposium into an influential academic event amplifying ‘China’s voice’ internationally while fostering quality-driven advancement within financial accounting disciplines.

Professor Paresh Narayan expressed his gratitude to Business school for hosting this seminar, and hoped that by providing academic support for this seminar, relevant academic results would be published in international high-quality journals, so as to expand the international influence of research results on China's state-owned enterprise reform, and looked forward to continuing in-depth cooperation in the future.

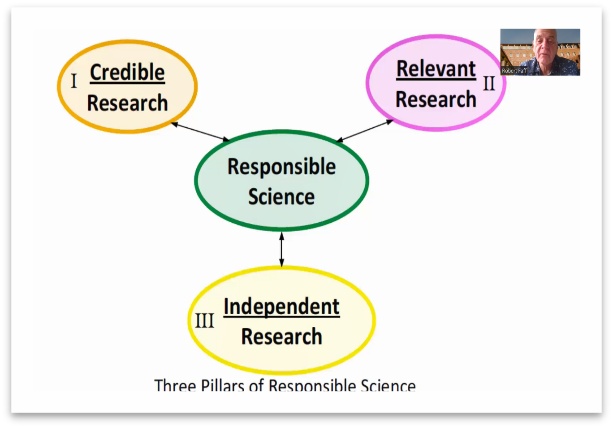

In the keynote speech, Professor Paresh Narayan introduced the important application of panel data structure mutation model in the study of public emergencies, and Professor Robert Faff shared the pre-registration process and its important significance for research reproducibility and credibility, which provided important ideas for scholars to carry out high-level international academic research. Focusing on the generality and uniqueness of high-quality development of state-owned enterprises, Professor Huang Shujian analyzed the internal requirements and external influences of solving the development problems of state-owned enterprises under the environment of fierce competition rules. Professor Wang Bin from Business School of Beijing Technology and Business University put forward the construction principles of financial theory and the new thinking of financial research in the context of Chinese modernization.

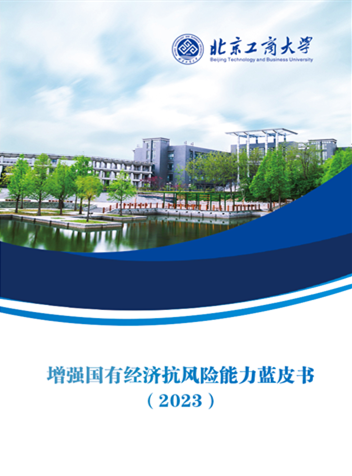

At the end of the forum, Professor Xu Xiaofang of Business School, on behalf of the Institute of State-owned Assets and State-owned Enterprises, issued the Blue Book on Enhancing the Resilience of State-owned Economy (2023). Based on the significance and connotation of the research on the anti-risk ability of the state-owned economy in the new era, the report constructs the measurement index of the anti-risk ability of the state-owned economy from three dimensions and four levels, and proposes the restrictive factors and enhancement paths for the improvement of the anti-risk ability of the state-owned economy based on practical measurement data. On this basis, an in-depth analysis is made of five typical cases of central enterprises. The report provides scientific decision-making support for the state-owned assets supervision department, helps to deeply understand the risk coping ability of state-owned enterprises, and has important practical guiding significance for the supervision of state-owned assets in the new era and the reform of state-owned assets and enterprises.

In the afternoon, the six sub-forums of the seminar discussed and exchanged 33 papers selected, covering important hot topics such as the reform and high-quality development of state-owned assets and enterprises, capital market and corporate governance, digitalization and ESG, uncertainty and risk management. In each session, the reporters focused on the theoretical innovation and research contributions of the conference papers, and the reviewers provided professional feedback and suggestions. The participating scholars actively participated in discussions and exchanges, which not only promoted the exchange and collision of academic ideas, but also brought new perspectives and inspirations for finance and accounting research.

Since its inception in 2021, the International Symposium on China's Capital Market and the Reform of State-owned Assets and State-owned Enterprises has been successfully held for three sessions, and its influence at home and abroad has steadily increased, and it has become an important platform for domestic and foreign scholars to study related issues such as "China's capital market and the reform of state-owned assets and state-owned enterprises". The establishment of this academic platform is not only an important starting point for our university to exert its research expertise in state-owned assets and state-owned enterprises and serve the important issues of national state-owned assets and state-owned enterprises reform, but also an important strategic layout for our university to implement the development of Beijing. In the future, our university will collect superior resources and strive to build it into an important think tank platform for the SASAC of The State Council and the Beijing Municipal Government on issues related to the reform of state-owned assets and state-owned enterprises.